UK Employment Law Updates

UK Employment Law Updates January 2024

We’ve entered a new year which means there’s even more UK Employment Law updates just around the corner. Staying compliant with these updates is crucial for businesses to maintain a harmonious and legally sound work environment.

In this article, we’ll explore some of the key legislation updates in the UK for 2024 and how they may impact your organisation.

Minimum Wage

To keep pace with rising living costs, the National Minimum Wage and National Living Wage have seen increases in 2024. The National Living Wage for 21-year-olds and over will increase from £10.42 to £11.44 from April this year.

The new rates for 18-to 20-year-olds will be £8.60, and Apprenticeship wages will increase from £5.28 to £6.40 an hour.

It’s essential for employers to keep up with these UK Employment Law updates to ensure their employees are paid in compliance with the law. Failure to do so can result in fines and/or legal consequences.

Carer’s Leave Act

From 6th April 2024, the Carers Leave Act will officially become part of legislation. This means that employees will be entitled to one week of unpaid leave every year if they care for dependants with long term needs. This will also be a day one right.

According to the Act, ‘Long term needs’ includes:

- Old age

- Physical or mental illness/injury that could require care for more than three months

- Condition that aligns with the definition of disability, under the Equality Act 2010.

We recently published a blog on the progression of the Carer’s Leave act and what it involves. You can take a look at it here.

Protection From Redundancy

Another update to UK Employment Law for 2024 is the Protection and Redundancy Act 2023. Expanding on the current protections in place, this act provides further redundancy protections to employees who are on or returning from maternity, paternity, adoption, or shared parental leave.

Currently, these employees have the right to be offered a suitable alternative job role if available over other staff at risk of redundancy.

The Government has decided to take this a step further to include pregnant staff, right from notifying their employer of their pregnancy, to 18 months after childbirth.

Flexible Working Act

The Flexible Working Act 2023 is one of the UK Employment Law Updates we get asked about the most. This Act grants employees the statutory right to request flexible working arrangements, regardless of their length of service. In addition, making it easier for individuals to balance their work and personal lives. Under the Act, employers are obligated to consider these requests seriously. They can only refuse them for specific, legitimate business reasons.

Employees will also be able to make two requests in a 12-month period and employers will have to make their decision in two months instead of three months.

This represents a significant shift towards a more adaptable and inclusive working environment, recognising that employees have diverse needs and circumstances.

Holiday Pay, and TUPE

Finally, other UK employment law updates that has come in to force this January involves Holiday Pay, and TUPE. To make calculating holiday pay for part-time and irregular-hours workers easier and fairer, holiday pay will be calculated as 12.07 per cent of hours worked in a pay period.

Alongside holiday calculation updates, the Government has also introduced new regulations regarding TUPE. This includes allowing small businesses to engage with their employees directly if there’s currently no worker representatives in place. If there are representatives in place, employers must consult with them.

In Conclusion

In 2024, UK employers face a rapidly changing employment law landscape that emphasises transparency, equality, and employee well-being. Staying informed and compliant with these updates is essential to avoid legal issues and maintain a positive work environment. It’s advisable to consult with legal experts or HR professionals to ensure that your business adapts to these changes effectively while fostering a workplace that values its employees’ rights and well-being.

Contact Us

If you would like any further information on UK Employment Law Updates, or would like our support contact us now.

UK Employment Law Updates September 2022

Most of us are still trying to get our heads round last week’s mini budget 2022.

Whilst a lot of focus was on tax reform, the UK Government also shared some changes in relation to employment law. The publication of the Retained EU Law (Revocation and Reform) Bill was announced.

Through this Bill the Government could potentially make the most radical changes to UK employment law for many years.

As part of their agenda to reduce “red tape” for UK business, the Government has announced that the IR35 legislation is to be repealed from April 2023. This is in so far as it places on us upon employers to assess the status of their contractors, alongside other liabilities.

Retained EU Law (Revocation and Reform) Bill

With a view to reducing costs to UK business of £1 billion, this Bill included in the mini budget 2022 aims to revoke EU-derived subordinate legislation and retained direct EU legislation by 31st December 2023, unless otherwise preserved (or extended to 2026).

It is also not clear how significant change to EU-derived employment protections might sit with the terms of the UK’s Brexit Trade Agreement terms with EU. The UK is not obliged to track future EU law. Therefore, scaling back workplace legal rights is also not without complication and risk.

For employers, the potential for change and the fact that the clock has started ticking is something to be watched closely.

With this bill and the mini budget 2022, the new government has claimed to show its commitment to a hard Brexit. However, this may have a far greater impact on workers’ rights than many would have predicted.

The workers’ rights which are at stake under the Bill include:

- The right to holiday pay

- The protection of workers’ rights in mergers and acquisitions (TUPE)

- The right not to work more than 48 hours per week

- The protection afforded to part time and fixed term workers

It is too early to comment on how far things will go. However, you can bet things are going to get interesting. It’s concerning that after so many years of basic employment rights receiving the sort of protection we would expect in society, that these are even up for discussion. Interesting times ahead and we will of course be monitoring this closely.

Repeal of IR35 legislation

The IR35 has also been discussed along side the mini budget 2022. The off-payroll working rules (IR35) have been in existence since the early 2000’s. It was designed to ensure that individuals who provide their services via an intermediary and who work in a similar way to employees, such as some contractors, consultants and freelancers, pay broadly the same income tax and national insurance contributions as employees. Due to government concerns over non-compliance with the original IR35 rules and, specifically, an underpayment of tax, reforms to these rules were introduced in the public sector in 2017. It was subsequently extended to much of the private sector in 2021. Furthermore, placing onus for tax determination and payment upon the client, rather than the individual.

The new Prime Minister had previously expressed criticism of the 2017 and 2021 changes to the IR35 rules. This is in terms of the administrative and financial burden they place upon employers. Others have speculated that the engagement of workers through this route has also declined significantly as a result. It’s also believed that it has increased, rather than resolved, uncertainty of their tax and employment status.

The Government has now announced that, from 6 April 2023, these IR35 rule changes will be repealed. The individual workers and their personal service companies will once more be responsible for self-identifying their tax status and liability.

You may find these links helpful to give some more background:

- Retained EU Law (Revocation and Reform) Bill

- BEIS in the Growth Plan (including reference to the repeal of the IR35 rules)

If you would like any further information on the mini budget 2022, our outsourced HR Consultants are more than happy to help. We can also offer advice on UK employment law changes.

UK Employment Law Updates March 2022

2021 was another year of tackling COVID-19. We also learned about navigating business with furlough ending, Changes to the off-payroll tax legislation, flexible working, and going in and out of restrictions. As we make our way through 2022, we have even more UK Employment Law Changes to take note of.

We started the new year with a new variant meaning more restrictions and uncertainty. This has brought back other challenges including how to manage home-working, planning for business continuity, redundancies and ensuring the health, safety and wellbeing of your employees.

As we get closer to ‘normality’, it’s important to keep a track of these changes, so you can understand your responsibilities.

National Minimum Wage & National Living Wage

From 1st April 2022, the National Living Wage will increase from £8.91 to £9.50 which is a 6.6% percent increase.

The National Minimum Wage will also change from 1st April. These increases include:

- 21 – 22 year old rate:

- Current rate: £8.36

- Rate from 1st April: £9.18

- 18 – 20 year-old rate

- Current rate: £6.56

- Rate from 1st April: £6.83

- 16-17 Year Old Rate:

- Current Rate: £4.62

- Rate from 1st April: £4.81

- Apprentice Rate:

- Current rate: £4.30

- Rate from 1st April: £4.81

- Accommodation Offset:

- Current rate: £8.36

- Rate from 1st April: £8.70

These changes are fast approaching so it’s important you put everything in place to make this increase before 1st April.

Statutory Sick Pay

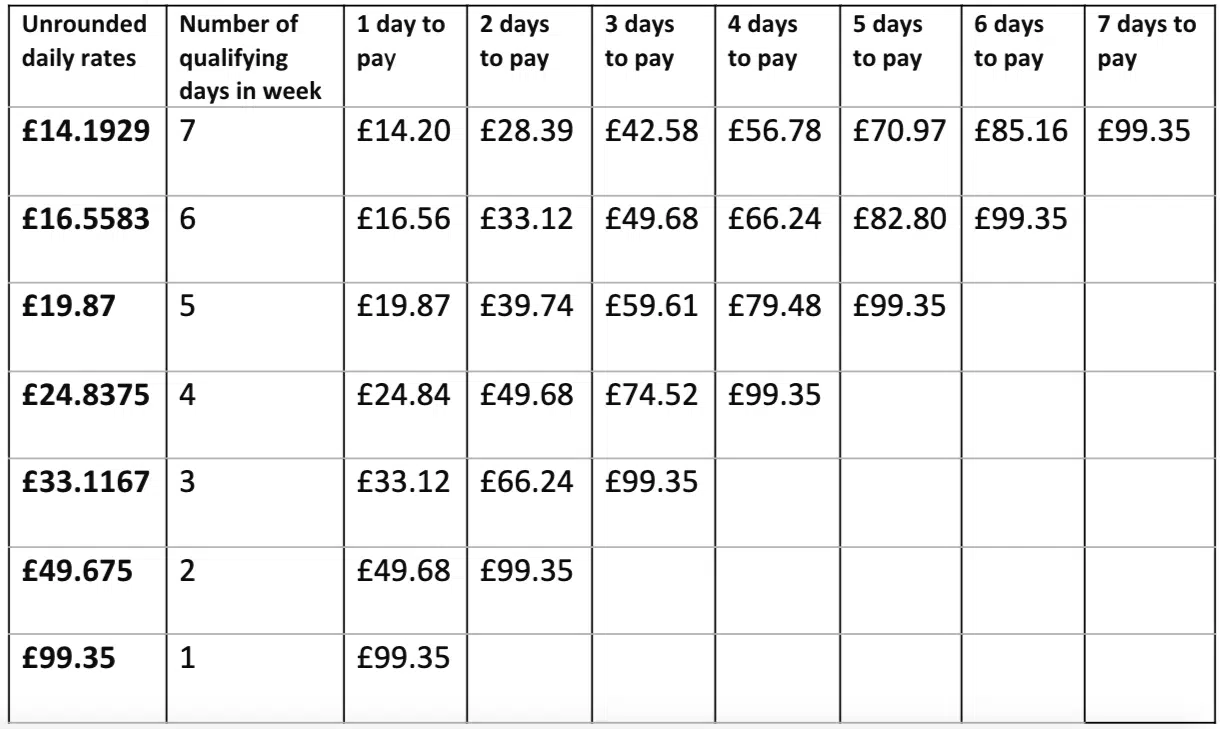

It’s important to note that the same weekly Statutory Sick Pay rate applies to all employees. However, the daily rate you need to pay staff for each day they’re off work due to illness is dependent on the amount of ‘qualifying days’ they work every week. You can use the Statutory Sick Pay calculator on the Government website to work this out.

SSP is as follows:

Maternity, Paternity, and Adoption

The updated rates for maternity, paternity, and adoption are as follows:

Statutory Maternity Pay

- The weekly rate for the first 6 weeks is 90% of your employee’s average weekly pay.

- The weekly rate for the remaining weeks is £156.66 or 90% of the employee’s average weekly earnings (whichever is lower)

Statutory Paternity Pay

- The weekly rate is £156.66 or 90% of the employee’s average weekly earnings (whichever is lower)

Statutory Adoption Pay

- The weekly rate for the first 6 weeks is 90% of your employee’s average weekly pay.

- The weekly rate for the remaining weeks is £156.66 or 90% of the employee’s average weekly earnings (whichever is lower)

Statutory Shared Parental Pay

- The weekly rate is £156.66 or 90% of the employee’s average weekly earnings (whichever is lower)

Statutory Parental Bereavement Pay

- The weekly rate is £156.66 or 90% of the employee’s average weekly earnings (whichever is lower)

These updated rates will be a legal requirement from 3rd April 2022.

The Extra Bank Holiday

There will be an extra public holiday on 3rd June 2022 to celebrate the Queen’s platinum jubilee. The late May bank holiday has been moved to 2nd June to give workers a four-day weekend.

As with all bank holidays, this can be added onto the employees leave entitlement and taken at a later date if this how you currently operate. The additional bank holiday should be treated and used in the same way as existing bank holidays. Find out if your employees are entitled to the extra bank holiday by reading our latest blog.

UK Employment Law Updates 2021

2020 was the year that saw us have to learn about furlough, the Coronavirus Job Retention Scheme (CJRS), the CJRS bonus that was then deferred, SSP, the Good Work Plan, IR35 changes which were then put on hold plus much more. This continues with UK Employment Law Changes 2021.

2021 has started with another lockdown and other challenges including how to manage homeworking, planning for business continuity, redundancies and ensuring the health, safety and wellbeing of your employees.

We’ve not even discussed Brexit!

If you’re a business owner it’s important to keep a track of these changes, so you can understand your responsibilities.

Here is a summary of what to expect in 2021:

IR35

Changes to the off-payroll tax legislation, IR35, which was due to be implemented in April 2020, have been deferred to 6 April 2021. This means HR should identify any self-employed consultants in their workforce who offer their services through a limited company (personal service company). They should use the government online tools to ascertain if there will be an obligation on the company to deduct income tax and national insurance contributions at source when paying the contractor. HR will also need to make clear in all consultant contracts whether they fall inside or outside IR35. The changes will only affect medium to large companies.

Positive discrimination

It is important that HR reminds boards of the difference between positive discrimination and positive action when asked to ‘improve diversity’. Positive action includes expressly saying that applicants are welcome from under-represented groups such as women or those from minority ethnic groups. It includes advertising roles in places where those who are under-represented are likely to see them. But appointing someone into a role just because they have a protected characteristic is positive discrimination. The only time a candidate’s protected characteristic should be considered is in a ‘tie break’ situation when there is no other way of separating two candidates.

New UK employment legislation

In December 2019 the Queen’s speech heralded a number of proposed pieces of legislation. Some of these may have been overtaken by the events of the last nine months, but the key ones for HR are:

- Extension to redundancy protections to prevent pregnancy/maternity discrimination There is a popular myth that you cannot make those on maternity leave redundant. This is not correct. While you must not make them redundant because they are on maternity leave, you must treat all employees fairly and equally, which means including those on maternity leave in a pool with colleagues. However, if they are selected for redundancy while on maternity leave then a woman has enhanced rights to be placed into a vacant role for which they have the skills without competitive interview. The government intends to extend that protection for six months after the woman returns from maternity leave.

- Introducing an entitlement to one week’s leave for unpaid carers In March 2020, the government issued a consultation paper and asked for responses by 3 August 2020. In this paper they proposed allowing unpaid carers to have an additional one week unpaid leave a year. The response to this consultation has not yet been published.

- Allowing parents to take extended leave for neonatal care Following consultation in 2019, the government published a response in March 2020 confirming that parents of babies that are admitted into hospital as a neonate (28 days old or fewer) will be eligible for neonatal leave and pay if the admission lasts for a continuous period of seven days or more. They will be entitled to this from day one of their employment and up to a maximum of 12 weeks. There have been no further details published, including the level of the neonatal pay.

- Making flexible working the default unless employers have a good reason not to This proposal, introduced in 2019 under the flexible working bill by Conservative MP Helen Whately, failed to complete its passage through parliament by the end of the session, which means it will not progress. However, although the Queen announced that legislation would be implemented to give effect to this, it is likely to have been overtaken by the events in recent months. All employers have been forced to look at whether their employees can work from home, with some having to juggle childcare as well as do their jobs, and a lot of myths and preconceived ideas have been firmly put to rest.

- A new, single enforcement body for employment rights Consultation closed in October 2019 and as yet no further details have been published, but the intention is to have one body enforcing minimum wage, unpaid tribunal awards and the tribunal penalty scheme, regulating statutory sick pay and publicising employment rights.

- Passing legislation to ensure tips left for workers go to them in full Specially referred to in the Queen’s speech, this would implement the Employment (Allocation of Tips) Bill.

- A new right for all workers to request a more ‘predictable’ contract No details have yet been published, but this is to address the perceived imbalance of zero-hours contracts

2020 Employment Law Changes and HR Updates

The first week of the New Year is out the way and everyone is now back into the usual routine. The year has started with a new government, Brexit just around the corner, and a number of employment law changes this year that will impact on employers. A number of the key changes to the UK employment law take place in April 2020, so now is the time to ensure you have put these measures in place.

We wanted to share some of the key developments to ensure your business is fully prepared. Here’s our 7 Point Checklist:

1. Conduct Brexit workforce planning

Following Brexit on 31 January 2020, there will be a transition period until 31 December 2020. In addition, EEA nationals will still be able to come and work in the UK.

You should ensure that all your EEA workers obtain settled or pre-settled status. This will enable them to stay at the end of the transition period. The current position is that EEA nationals who are resident in the UK by 31 December 2020 have until 30 June 2021 to make an application.

You should also prepare for the new immigration system that will be in place after the transition period. The Migration Advisory Commission is expected to report in January 2020, having considered options for a new points-based system.

If you have not already done so, you should carry out an audit of your workforce and consider where there may be staffing issues if you currently rely on EEA nationals. You should look for potential skills gaps and consider the impact of the new immigration system. You may need to obtain a sponsor licence to recruit the staff you need from abroad.

2. Statutory Rate increases and National Minimum Wage

The rates for the national minimum wage will increase on 1 April 2020. The national living wage rate, for workers aged 25 and over, will increase from £8.21 to £8.72 per hour. The rates for younger workers will also increase, with hourly rates rising to £8.20 for workers aged at least 21. Furthermore, under 25 will rise to £6.45 for workers aged at least 18 but £4.55 for workers aged under 18 who are no longer of compulsory school age. The rate for apprentices will rise to £4.15 per hour.

You should ensure that you also comply with changes to other statutory rates. The proposed rate for statutory maternity, adoption, paternity and shared parental pay is £151.20, up from £148.68. The increase normally takes effect on the first Sunday in April, which in 2020 is 5 April. The rate for statutory sick pay is expected to increase on 6 April 2020. The proposed new rate is £95.85, up from £94.25 per week.

Based on current projections, the NMW rate by April 2024 could be £10.50 per hour.

3. Amend policies to include parental bereavement leave and pay

The right to parental bereavement leave and pay is expected to come into force in April 2020. The right will allow parents of a child under the age of 18 who has died to take two weeks’ leave. It will be available to the birth parents or those with parental responsibility for the child and can be taken within 56 weeks of the child’s death, in a block of two weeks, or two blocks of one week.

Employees will be entitled to parental bereavement leave from day one of their employment. However, there will be a qualifying period of 26 weeks for entitlement to parental bereavement pay.

The government has not yet published the regulations that will finalise the details for the introduction of parental bereavement leave and pay. We will of course keep you posted on these developments in due course.

4. New rules on written statements of particulars

From 6 April 2020, you must provide a written statement of employment particulars to all workers, not just to employees. The current approach where you can issue during the first 8 weeks of employment will be replaced with this new change. In addition, you must supply this on Day 1 of employment at the latest.

We believe you should be doing this well in advance anyway – you want your new employees to know all the terms and conditions before they accept your offer of employment, and this reduces any confusion.

The information that you provide to your new employees will also be expanded to include extra information on variable working hours. This also includes paid leave other than sick pay, benefits, probationary periods and training. This is quite a change and therefore employment contracts will need updated to reflect this.

5. Holiday pay for workers with irregular hours

There’s a big change coming around holiday pay. The reference period for calculating holiday pay for workers who do not work regular hours will increase from 12 to 52 weeks on 6 April 2020.

This change is part of the Government’s Good Work Plan and will help workers missing out on holiday pay if they take annual leave in the 12 weeks following a quieter period at work.

You will now need to pay workers who do not work normal hours their average weekly pay, calculated over the previous year, rather than the previous 12 weeks. We’ve seen a number of successful cases recently where some employers continue to not pay average pay for holidays, and we would urge any employers still adopting this practice to proactively change their approach before April 2020. The Government has committed to a Holiday Pay Awareness Campaign prior to these changes coming in. If you’re not complying now, you can expect Employment Tribunal claims which can be backdated. It’s far better to act now and avoid such claims.

In the future, there will also be a state-led enforcement regime to assist “vulnerable” workers. We await further developments on this.

6. Good Work Plan

The Good Work Plan comes into effect in April. We’ll share further information on this in the coming weeks, but key priorities include:

Right to request a more predictable and stable employment contract

This new right will mean an employee can request a more predictable and stable employment contract after 26 weeks of employment.

Examples of what might be requested include a guaranteed minimum number of hours and certainty as to the days on which they will be asked to work.

This new development will predominantly benefit individuals who are employed as casuals or on zero hours contracts. An employer will have three months to make their decision on any such request.

Break in continuous service

Currently, a gap of just one week can break an individual’s continuity of service. This break period will be extended from one week to four weeks, helping those employees who work on a sporadic or casual basis to qualify for more employment rights (such as the right not to be unfairly dismissed or the right to statutory maternity pay) that require a particular length of service.

Protecting agency workers

After 12 weeks of service, an agency worker is entitled to receive the same level of pay as a permanent worker. Furthermore, this is unless the agency worker opts out of this right and instead elects to receive a guaranteed level of pay between their temporary roles.

This opt-out will be removed (proposed to take effect in April 2020) because often agency workers are financially worse off.

Tips and gratuities

Rules will be implemented to ensure that tips are passed directly to the individual, rather than taken by the employer.

Statement of basic terms

From April 2020, it will not just be employees who are entitled to receive a written document setting out their basic terms. Furthermore, the right will be extended to workers too. This is a new entitlement that should bring clarity for many workers regarding their contractual terms.

Holiday pay

The reference period used to calculate holiday pay will be extended from 12 weeks to 52 weeks, which is an important development for those who work variable hours. Currently a worker may get different rates of pay during holidays taken. This is depending on how many hours they worked in the three months previous.

In response to recent case law, there will also be a campaign to ensure that individuals better understand their rights and a new holiday entitlement calculator will be launched.

State enforcement of holiday pay

Currently, when an employer does not pay holiday pay correctly, the individual has to bring employment tribunal proceedings. In the future, there will also be a state-led enforcement regime to assist “vulnerable” workers. We await further developments on this.

Naming and shaming

Employers who do not pay the compensation awarded by an employment tribunal following a successful claim will now not only face potential enforcement proceedings (where a penalty notice can be issued of up to 50% of the unpaid award) but also the prospect of being publicly named and shamed. This will seriously damage reputations.

As you can see, there are lots of changes on the horizon as a result of the Good Work Plan. In addition, you will want to start thinking practically about how it will impact you and how we can help.

7. Look out for other changes on the horizon

In the Queen’s speech in December, the UK government announced that there will be an Employment Bill. The key elements of which would be:

- “creating a new, single enforcement body, offering greater protections for workers;

ensuring that tips left for workers go to them in full; - introducing a new right for all workers to request a more predictable contract;

- extending redundancy protections to prevent pregnancy and maternity discrimination;

- allowing parents to take extended leave for neonatal care; and introducing an entitlement to one week’s leave for unpaid carers; and

- subject to consultation, making flexible working the default unless employers have good reason not to.”

Summary

So, lots to do in 2020. In addition to all of the above, this year will also be important for employers in terms of attracting and retaining talent. As such, it’s vital you build the capability of your Leadership Teams and create a positive workplace culture.

Employment Law Changes April 2020

Although everyone is focused on Covid-19 and rightfully so, new legislation has crept up on us. In addition, some major employment law changes April 2020 to existing employment regulations comes into force from today, 6 April 2020.

We have already been working with our clients on this from the start of the year. Furthermore, we ran seminars on this during the month of March. Earlier today, we also hosted a webinar on The Good Work Plan.

The key changes are here: Written terms (‘written statement of employment particulars’)

Staff now have the same right as employees to written terms (a ‘written statement of employment particulars’) from their employer.

Employers must provide their workers and employees with their written statement on or before their first day of employment. This is no matter how long they’re employed for. Our advice here is to send out these details at the point your new employee and worker accept your offer of employment. In addition, it’s important they know all the terms they are signing up to and far better for you to iron out any issues up front, rather than wait until the first day of employment.

You can email these out electronically, along with a copy of your Employee Handbook. If you’re using software to do this, take advantage of automation.

The written statement must include details about:

- The hours and days of the week the worker or employee is required to work, and whether they may be varied and how

- Entitlements to annual leave

- Any other benefits not covered elsewhere in the written statement – for example, private health care, life assurance, dental treatment etc.

- Probationary period including how long this will last and how it will be assessed

- Any training provided by the employer

Changes to holiday pay calculations

From 6 April 2020, the time used to calculate a week’s pay for holiday pay purposes increases from the previous 12 weeks of work to the previous 52 weeks. We’ve been educating businesses on this for some time. This is extremely important where a worker or employee works variable hours or works regular overtime.

Agency workers’ rights

The Swedish Derogation (referred to as ‘pay between assignments’ contracts) is abolished from 6 April 2020. In addition, all agency workers are entitled to the same rate of pay as permanent staff after 12 weeks.

All agency workers are entitled to a key information document that clearly sets out the type of contract they will have and the pay they’ll receive. You should have an audit trail in place with your agencies to ensure you have checked they have provided this information to the agency worker.

ICE (Information and Consultation of Employees) Regulations

From 6 April 2020, it’s been made easier to request an information and consultation agreement. A minimum of 2%, rather than 10% of staff (or at least 15 people), in workplaces with 50 employees or more can request a formal agreement to be informed and consulted about workplace matters.

We don’t see a lot of formal Employee Forums in place where there is no collective agreement in place with a Trade Union. However, it’s good practice to have regular communication forums in place. If you don’t, then you run the risk of your staff requesting this and driving the agenda – we would suggest it’s far better for you as the employer to take the initiative here.

Parental bereavement leave and pay

The Parental Bereavement Leave and Pay Act 2018 gives all employed parents the right to 2 weeks’ paid leave if their child aged under 18 dies. This also applies if they have a stillbirth at 24 weeks or later. You should ensure your policies reflect this change.

If you’re looking for further information, you can download our eBook on The Good Work Plan here. You can also read our blog here.

If you’re looking for guidance relating to Covid-19, you can check out our FAQs.

Employment Law Changes April 2019

With employment law changes 2019 are happening in April, we want to give you some top tips to make these changes less stressful.

Prepare for Statutory Pay Rates Increase 2019

Staff are entitled to a full year of statutory pay as part of their maternity leave. This is the basic pay an employer is expected to pay. The current rate of statutory pay is £145.18 a week. It can also be 90% of the employees average weekly pay if less than the statutory rate. This is an employment law changes 2019 that you must plan in advance.

Statutory pay will rise to £148.68 in April 2019. It is always expected that the statutory maternity and paternity rates rise every April. In addition, you must include this in your business plan every year.

It is also crucial that you consider statutory sick pay in your plan as this will also increase from £92.05 to £94.25 in April. This information will help you to plan your budget for 2019 more accurately. We also encourage you to look at your policies such as family-friendly benefits and make appropriate amendments.

Prepare for Automatic enrolment contributions increase

Another employment law changes 2019 is automatic enrolment contributions increase. The minimum you and your employees are expected to pay into your automatic enrolment workplace pension scheme is planned to increase. The rate in 2018 overall was 5% with the employer paying 2% and the employee paying 3%. This will increase to 8% overall in 2019 with employers contributing 3% and staff contributing 5%.

If you have employees in a pension scheme, you must put this in place to ensure the minimum amount of pension contributions are being paid. The amount an employer and staff member pay depends on the pension scheme you have chosen. If you would like further help with employment law changes 2019, contact our team now. If you don’t have staff in an automatic enrolment scheme or you are paying above the expected rate, you don’t have to to take further action.

Employment Law Changes April 2017

April is normally a busy time for HR professionals and small businesses, where historically a number of changes to employment legislation take place. This April is no different, and we felt it appropriate to share some of the key changes that may affect your business over the coming weeks.

National minimum wage increases

On 1 April 2017, the rates of the national minimum wage will increase, despite an increase in most rates on 1 October 2016.

This is so that the timing of the annual increase in the national living wage rate for workers aged 25 or over can align with the other national minimum wage rates.

The rate for workers aged 25 and over will increase from £7.20 to £7.50. The rates within the other age bands also increase. Please see the details below:

| April 2017 | 25 and over | 21 to 24 | 18 to 20 | Under 18 | Apprentice |

| New Rate | £7.50 | £7.05 | £5.60 | £4.05 | £3.50 |

Statutory family-related pay and sick pay rates increase

The rate of statutory maternity pay (SMP) is rising to £140.98 from April 2017. The increase normally occurs on the first Sunday in April, which in 2017 is 2 April.

Also on 2 April 2017, the rates of statutory paternity pay and statutory shared parental pay will go up from £139.58 to £140.98 (or 90% of the employee’s average weekly earnings if this figure is less than the statutory rate).

The rate of statutory adoption pay increases from £139.58 to £140.98.

Statutory Sick Pay (SSP will also increase to £89.35 from 6 April 2017. The lower earnings limit will also rise from £112.00 per week to £113.00.

Statutory redundancy pay increases

New limits on employment statutory redundancy pay come into force on 6 April 2017.

Employers that dismiss employees for redundancy must pay those with two years’ service an amount based on the employee’s weekly pay, length of service and age.

The weekly pay is subject to a maximum amount. From 6 April 2017, this is £489, increasing from £479.

Tax advantages under salary-sacrifice

Benefits-in-kind attracting tax and NIC advantages when they are provided under a salary-sacrifice scheme, are to be limited.

This change is expected to take effect from 6 April 2017, with some exemptions.

Arrangements already in place are protected until April 2018, and until April 2021 for some.

5 Employment Law Changes 2016

As of the 11th of January 2016 The Exclusivity Terms in Zero Hours Contracts (Redress) Regulations, 2015 comes into play.

The aim of the new law is to ensure that employees on zero hours’ contracts are protected from detriment and dismissal for breaching an exclusivity clause in his or her contract of employment by doing work or performing services under another contract or other arrangement.

Exclusivity Clauses in Zero Hours Contract

As of the 11th of January 2016 The Exclusivity Terms in Zero Hours Contracts (Redress) Regulations, 2015 comes into play.

The aim of the new law is to ensure that employees on zero hours’ contracts are protected from detriment and dismissal for breaching an exclusivity clause in his or her contract of employment by doing work or performing services under another contract or other arrangement.

A worker on a zero hours’ contract will be able to bring a complaint to an employment tribunal for compensation if they are subjected to a detriment or dismissed.

National Living Wage Introduced

The National Living Wage, initially set at £7.20 will be introduced from the 1st of April 2016.

For the first time, employers will need to pay staff aged 25 and over the national living wage, which will work as a new top rate of the national minimum wage. For those aged under 25, lower national minimum wage rates will apply.

Gender Pay Gap Reporting

Regulations will be introduced in June 2016 making it compulsory for large organisations with 250 employees or more to publish information about their gender pay gaps including details of gaps in bonus payments.

Employers will be given the chance to get used to the new regulations before reporting requirements come into force.

Public Sector Exit Payments

From April 2016 Repayment of Public Sector Exit Payments Regulations, 2016 comes into play. This means that employees in the public sector with annual earnings of £80,000 or more must repay exit payments where they return to work in the public sector within one year of leaving.

Statutory Parental Pay Rates and Sick Pay

The Government have announced that the annual increase in statutory parental pay rates and sick pay in 2016 had been frozen due to a fall in the consumer prices index.

Employer NICs abolished for apprentices under the age of 25

In Autumn it was announced that employer national insurance contributions for young apprentices would be abolished from April 2016. To make it cheaper to employ young people, employers will not have to pay Class 1 national insurance contributions on earnings up to the upper earnings limit for apprentices aged under 25. The new measure is contained in the National Insurance Contributions Act 2015.

5 Legislative Changes Affecting HR in the UK in 2013

Businesses are now required to submit real-time PAYE info to HM Revenue & Customs

Complying with legislation is an integral part of running a successful business.

As a business owner, it is up to you to make sure that your human resources department are up to date with current legislation and have amended associated documents to reflect the changes. In this article, we will explain five legislation changes which have affected Human Resources departments in the UK this year.

New PAYE real time information requirements

This year HMRC introduced the requirement of providing real-time information as part of PAYE. Although most companies were required to provide real-time information from April this year, there were some smaller companies which were granted permission to have an extra six months to become compliant. Seeing as the six months has now passed, all companies should now be providing HM Revenue and Customs with real time PAYE information.

It is essential that PAYE returns are submitted to HMRC either before or on the date that payments are made to employees. Businesses can provide their returns electronically through HMRC’s Full Payment Submission system. The real time information provided should include the amount paid, any deductions including National Insurance Contributions and Income Tax and the starting and leaving date where applicable.

Statutory increases to maternity / paternity pay and sickness

On 6th April 2013, it was announced that there would be a rise in statutory payments regarding maternity pay, paternity pay and sickness pay. Maternity and paternity pay rose from £135.45 to £136.78 a week. In order to qualify for maternity or paternity, pay individuals must now earn at least £109.00 a week, whereas before 6th April 2013 it was £107.00 a week. There has also been a rise in statutory sick pay. Since 6th April 2013, it increased from £85.85 a week to £86.70. In order to qualify for sick pay, employees must now earn £109.00 a week.

Cap on unfair dismissal

This year it was announced that there would be a cap on the compensation individuals could be awarded in claims of unfair dismissal. The compensation will now equal one year’s salary, rather than the existing limit of £74,200. In order to avoid cases of unfair dismissal, human resources should ensure that the appropriate procedures are in place to prevent unfair treatment and discrimination.

Collective Redundancy Consultation

The legislation now states that where a business is proposing to make one hundred or more employees redundant, there must be a forty-five day consultation period. Before this new legislation came into place, the consultation period was ninety days. Businesses that are planning on making fewer than one hundred redundancies but more than twenty also must ensure they carry out the thirty days of consultation as required by legislation.

Parental leave

Parents are now entitled to eighteen weeks off work

It is important that your Human Resources department are up to date on legislation regarding parental leave. On 8th March 2013, it was announced that parental leave would increase from thirteen to eighteen weeks. It is essential that human resources update their handbooks and any associated documents so that employees are aware of the changes to the legislation. Any employee applying for parental leave should now be entitled to have up to eighteen weeks off work.

Conclusion

This year we saw many changes in legislation that have affected human resources. It is essential that a business’s human resources department comply with legislation and ensure that employees are made aware of the changes. This can be done by amending employee handbooks, changing associated documents, sending out emails and publishing company blog posts. HR departments that fail to implement such changes may find themselves in trouble if their organisation ends up facing lawsuits due to their failure to comply with legislation.

Employment Law Changes October 2012

Larger employers subject to new pensions duties

The first staging date is 1 October for larger employers (those employing 120,000+) to comply with their new pensions duties. They have to:

- Auto-enrol eligible jobholders into a qualifying pension scheme and make contributions into the scheme;

- Enrol non-eligible jobholders who opt-in, and make contributions into the scheme; and

- Allow entitled workers to join a registered pension scheme.

National Minimum Wage

The annual increase in national minimum wage rates takes effect from 1 October 2012. The Government has confirmed that the adult rate will rise to £6.19. The rate for 16-17-year-olds will remain unchanged at £3.68 and for 18-20-year-olds will remain unchanged at £4.98.

Are you ready to elevate your HR strategies?

Connect with our expert HR team for tailored solutions and insights. Call The HR Booth at 01383 668178 or reach out via email at info@thehrbooth.co.uk or use the contact form.